Douglas Debt Consolidation

If you fail to pay your monthly credit card charges, your balance will be carried from month to month and can easily blow up your debt. It’s getting more and more difficult for American households to pay their monthly credit card bills.

An average American household is estimated to have around $135,768 current debt. With an average income, increasing cost of living, and multiple monthly bills, paying off debts is starting to seem like an impossible task to do.

Our Douglas certified debt consolidation experts at Optimal Debt Solutions fully understand how challenging it is to provide for your daily expenses and pay existing debts at the same time. We’ll help you start living with financial freedom again by working with you towards eliminating your debts.

Call Optimal Debt Solutions today at (205) 784-1723 for your Free Evaluation!

Money Management with Debt Consolidation

Debt consolidation is an effective financial strategy to make payments simple and easier to manage. Multiple debts will be combined into a single debt. Debt consolidation also results in a lower monthly payment or lower interest rate and, sometimes, even both.

The process of debt consolidation starts with a new and bigger loan that will help you pay off all your existing debts. If your credit card company offers a balance transfer feature, you can also take advantage of that. You have the option to take out a loan from banks, credit unions, or even online lenders. These loan programs usually require collateral before you can proceed with the loan process.

Paying off a single loan every month is undoubtedly more manageable than receiving several bills every month. You’ll be taking note of only one monthly payment deadline instead of several payment cycles. At Optimal Debt Solutions, we’ll even make things easier for you by offering alternatives to debt consolidation without involving a new loan. We can directly negotiate with your creditors to reduce the total amount of your debt. We’ll do what we can to help you save time and money. Our company is dedicated to helping Douglas, AL residents gain financial freedom as quickly as possible.

Debt Settlement vs. Consolidation

To be free from debt, you need a simple and effective debt management program. Although there are several ways to manage and pay off debts, our years of experience and extensive research have proven that debt settlement is one of the most effective methods to achieve financial freedom.

Debt consolidation will make payment schedules easier to follow, but it will not reduce your debt. You’ll be paying almost the same amount of money that you owe, with no discounts or reduced interest rates. It will be hard to quickly eliminate your debt unless you’ll spend significantly less and increase your payments. It will also take approximately two to five years to fully eliminate your debt through the debt consolidation program. You’ll only acquire a new obligation because you’ll be getting a new and bigger loan.

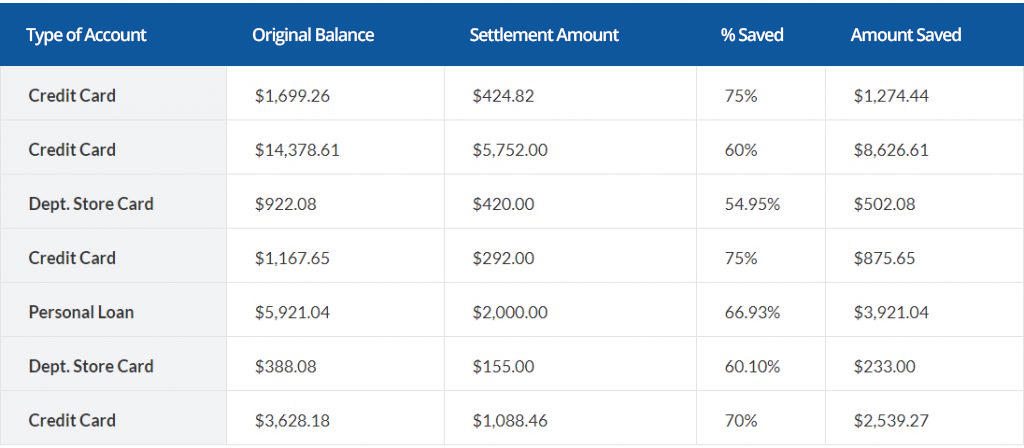

When it comes to debt settlement, you’ll have a great option to eliminate your debt. Our debt relief experts will work with you to understand your current financial situation, including your spending habits and the total amount of existing debts. We’ll even help you negotiate with your creditors so you can pay way less than what you originally owed. We’ll use our tried and tested strategies to make your creditors accept our offer that will significantly reduce your debt. We’ll also figure out a way to reduce the number of payments that you’ll have to make and help you get out of debt faster.

Take Control Of Your Finances

If you’re ready to start your journey towards financial freedom, then we are here to help you. Our certified Douglas debt management experts in will guide you throughout the entire process. Our process involves four easy steps. The first step is to avail of our free evaluation. A certified debt specialist will review your current financial status to fully understand your situation and give you suitable options to manage your debt.

Next, we’ll formulate a personalized debt reduction program to address your specific needs. We’ll discuss all the suitable debt settlement strategies with you. We’ll also assist you as you start your financial management program. We have a user-friendly online portal that can help you monitor your debt resolution program. You can also easily communicate with our debt experts through the online portal.

Then, we’ll start working on the negotiation and settlement of your existing debt. We’ll reach out to your creditors on your behalf and use our strategies to reduce your debt effectively. Finally, you just have to access our online portal to see the status and progress of your debt resolution plan. You can easily communicate with our debt specialists if you have questions.

If you want to start your journey towards a debt-free life in Douglas, contact Optimal Debt Solutions now.

Douglas Debt Settlement Company

Call Optimal Debt Solutions today at (205) 784-1723 for your Free Evaluation!